The Definitive Guide for Paul B Insurance Local Medicare Agent Huntington

the State Health Insurance Policy Assistance Program (SHIP) totally free, unbiased information and support. You can download and install a leaflet that finest describes Medicare Open Enrollment . Products concentrate on understanding the adjustments you can make during Medicare's Open Enrollment Duration, evaluating your existing Medicare health and medicine coverage, and also recognizing exactly how to make adjustments to your Medicare health and wellness and medicine insurance coverage.

Consider your strategy's information to make certain your medicines are still covered as well as your physicians are still in-network. Medicare health and medicine strategies change each year and also so can your wellness needs. Do you need a new primary treatment medical professional? Does your network consist of the expert you want for an upcoming surgery? Is your brand-new medicine covered by your present plan? Does an additional strategy use the same worth at a reduced expense? Analyze your wellness status and also establish if you require to make an adjustment.

To do this, check out Medicare. Starting in October, you can utilize Medicare's strategy finder device at to see what various other strategies are offered in your location.

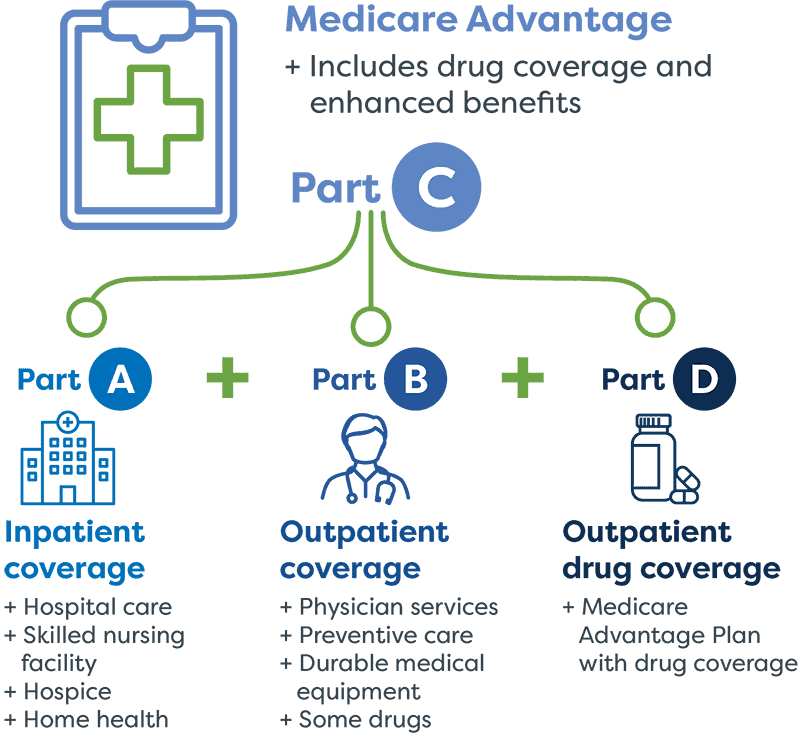

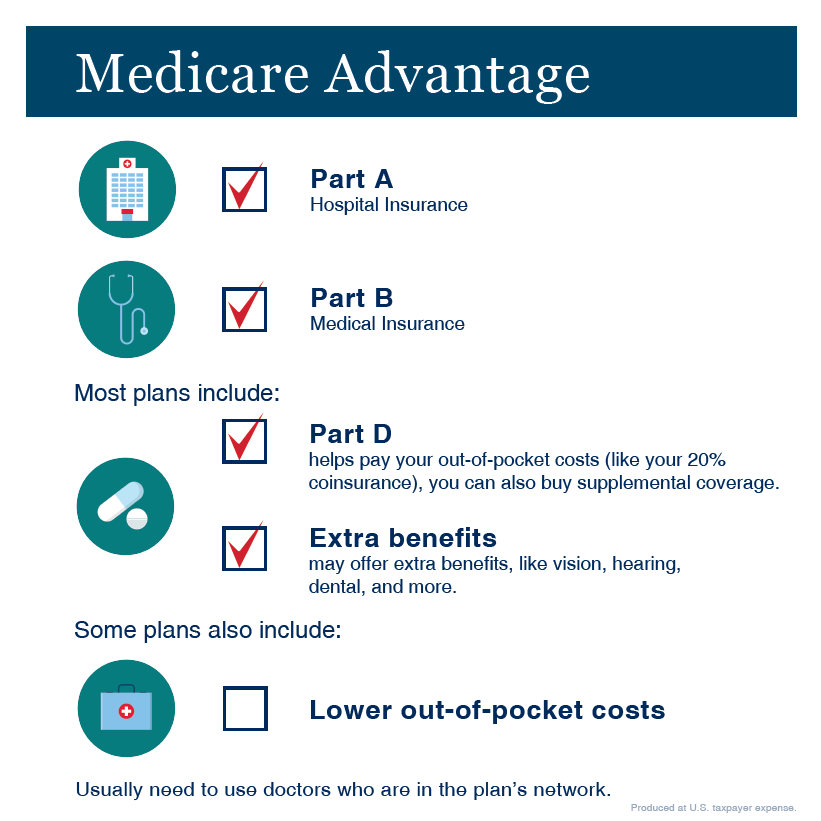

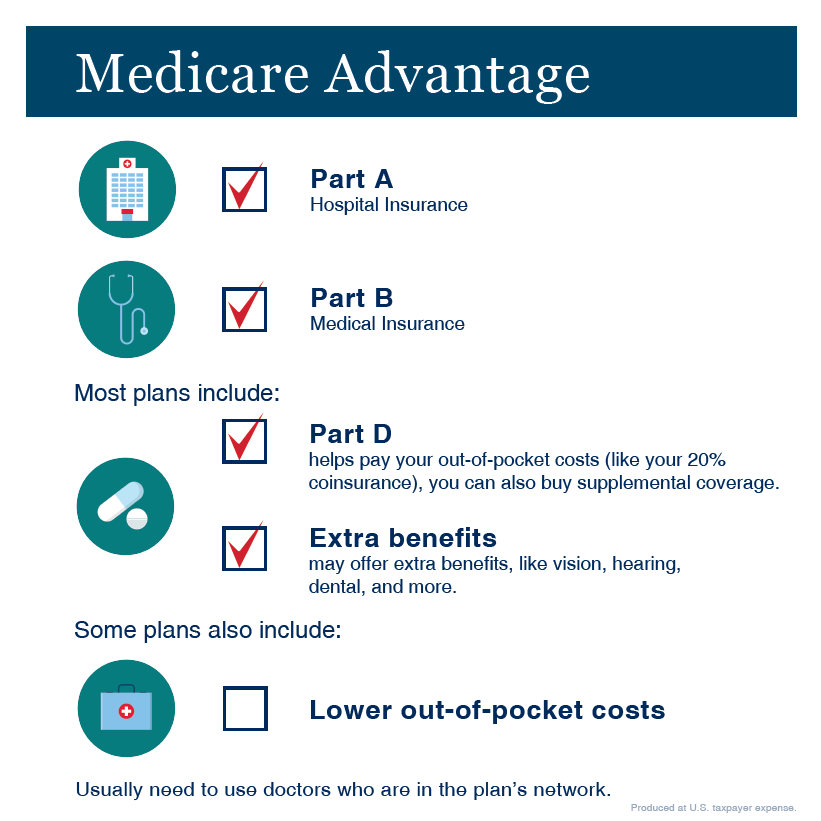

Keep in mind, throughout Medicare Open Registration, you can decide to remain in Original Medicare or sign up with a Medicare Advantage Plan. If you're currently in a Medicare Benefit Plan, you can switch back to Original Medicare. The Medicare Plan Finder has been upgraded with the current Star Scores for Medicare health as well as prescription medication strategies.

What Does Paul B Insurance Medicare Supplement Agent Huntington Do?

Make Use Of the Star Ratings to contrast the top quality of health as well as drug strategies being offered.The State Medical insurance Support Program (SHIP) supplies cost-free, objective support in all 23 areas as well as Baltimore City with in-person and telephone support. Volunteer chances are also available. To learn more concerning SHIP, select a classification below (paul b insurance local medicare agent huntington).

In addition to Medicare's Annual Open Registration Period, you can make the most of a separate Medicare Advantage Open Registration Duration from January 1 with March 31. Unlike the Medicare Yearly Open Enrollment Duration, this enrollment duration is only for people that are presently signed up in a Medicare Benefit plan as well as wish to make changes.

In this situation, you will also have the ability to sign up with a Medicare Part D Strategy. Maintain in mind that If you enrolled in a Medicare Benefit Strategy throughout your First Registration Duration, which is the join duration when you initially come to be eligible for Original Medicare, you can alter to an additional Medicare Advantage Plan or go back to Original Medicare within the initial 3 months that you have insurance coverage.

It is an excellent idea to evaluate your existing Medicare strategy every year to see to it it still satisfies your demands. For more info concerning the Medicare Benefit open registration duration, or help with your evaluation and plan comparison, call the Michigan Medicare/Medicaid Assistance Program (MMAP) at 800-803-7174 or visit their website at .

What Does Paul B Insurance Medicare Advantage Plans Huntington Mean?

It is necessary to recognize precisely when you end up being eligible for Medicare to stay clear of any late registration charges. Medicare qualification can be complex, so it is necessary to fully comprehend the requirements as well as understand when you end up being qualified. Find Medicare Strategies in 3 Easy Actions, We can assist find the ideal Medicare strategies for you today Reaching Medicare qualification can be confusing.

Paul B Insurance Medicare Insurance Program Huntington

Paul B Insurance Medicare Insurance Program Huntington

Below, you will certainly discover whatever you need to learn about Medicare qualification, demands, and credentials. To be qualified for Medicare, you have to meet specific standards established by the Centers for Medicare as well as Medicaid Services. These criteria consist of: You need to be a lawful local of the U.S. for at the very least five years.

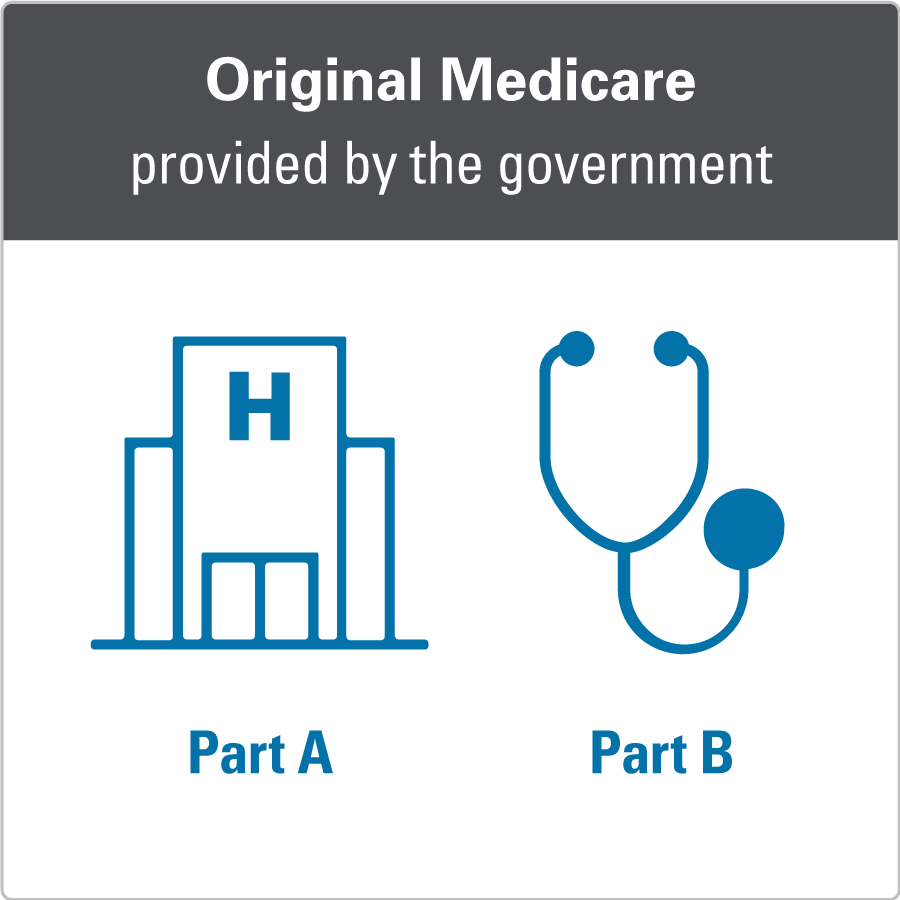

When you end up being qualified for Medicare, you are able to sign up in Medicare Component A, Part B, Part C (or a Medicare Supplement strategy), and Medicare Component D. Each part of Medicare uses you unique advantages that make up your health and wellness insurance protection. Medicare eligibility is straightforward. As soon as you satisfy the age or impairment needs, you will automatically get wellness insurance coverage via Medicare if you are an U.S.

for at the very least 5 years. Additionally eligible for Medicare are those more youthful than 65, collecting Social Safety Impairment Revenue (SSDI) benefits for at least 24 months, people with diagnoses of end-stage renal illness (ESRD) that call for a kidney transplant or dialysis, and those with amyotrophic lateral sclerosis (ALS). Typically, you need to go to the very least 65 years of ages to be qualified for Initial Medicare (Component An and Part B).

If you are not yet 65, you might come to

supplemental life insurance be qualified for Medicare based on your

learn the facts here now handicap status. If you obtain Social Protection Handicap Earnings (SSDI) checks for at the very least 24 months, you get approved for Initial Medicare. Discover Medicare Plans in 3 Easy Actions, We can help locate the ideal Medicare prepare for you today You end up being qualified for Medicare if you are: 65 years of age or older A UNITED STATE

for at least 5 consecutive years Nonetheless, there are some other circumstances in which you might be eligible for Medicare despite age, such as: You have actually been getting Social Protection Special needs Insurance (SSDI) for at the very least 2 years. You have end-stage renal illness (ESRD) or Lou Gehrig's illness (ALS).

The Best Strategy To Use For Paul B Insurance Medicare Advantage Agent Huntington

If you miss your IEP, you may have the ability to sign up throughout the General Registration Duration (GEP), which is from January 1 to March 31 every year. However, there might be charges for late registration, so it is necessary to register in Medicare throughout your Preliminary Registration Duration ideally. The Medicare eligibility age graph listed below reviews the credentials, demands, and eligibility age.

or a legal homeowner for a minimum of 5 years AND: Have a diagnosis of amyotrophic lateral sclerosis (ALS) or end-stage renal illness (ESRD). Get SSDI checks for at the

useful site very least 24 months. You are a resident of the U.S. or a legal homeowner for at the very least 5 years as well as: Paid Medicare taxes for at the very least 40 functioning quarters (one decade), so you receive premium-free Medicare Part A.

Income is not a consider Medicare qualification. You are qualified to protection if you fulfill the fundamental Medicare qualification demands. Your revenue will affect just how much you pay for protection. If you are a high earner with a yearly earnings over a particular restriction, you will be accountable for extra costs due to IRMAA.

See This Report on Paul B Insurance Medicare Agent Huntington

Paul B Insurance Medicare Agency Huntington

Paul B Insurance Medicare Agency Huntington

You might end up being eligible for low-income subsidies, Medicaid, as well as Medicare Savings Programs if your month-to-month income is below a specific threshold. paul b insurance medicare agent huntington. These programs supply financial aid to those on Medicare with low earnings to guarantee insurance coverage. Find Medicare Strategies in 3 Easy Steps, We can aid discover the right Medicare plans for you today Several believe Medicare is free, however just Medicare Part A hospital protection does not consist of a monthly costs if you or your spouse qualify.

Otherwise, you will certainly need to purchase right into Medicare Component A according to exactly how numerous functioning quarters you paid the tax obligation. Your premium-free Medicare Part An eligibility condition is available through your account. There, you can see the amount of eligible working quarters you paid Medicare tax obligations establishing your Medicare Part A premium expense.